OK SOS Form 0086 2012-2026 free printable template

Show details

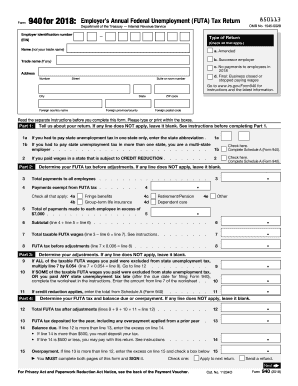

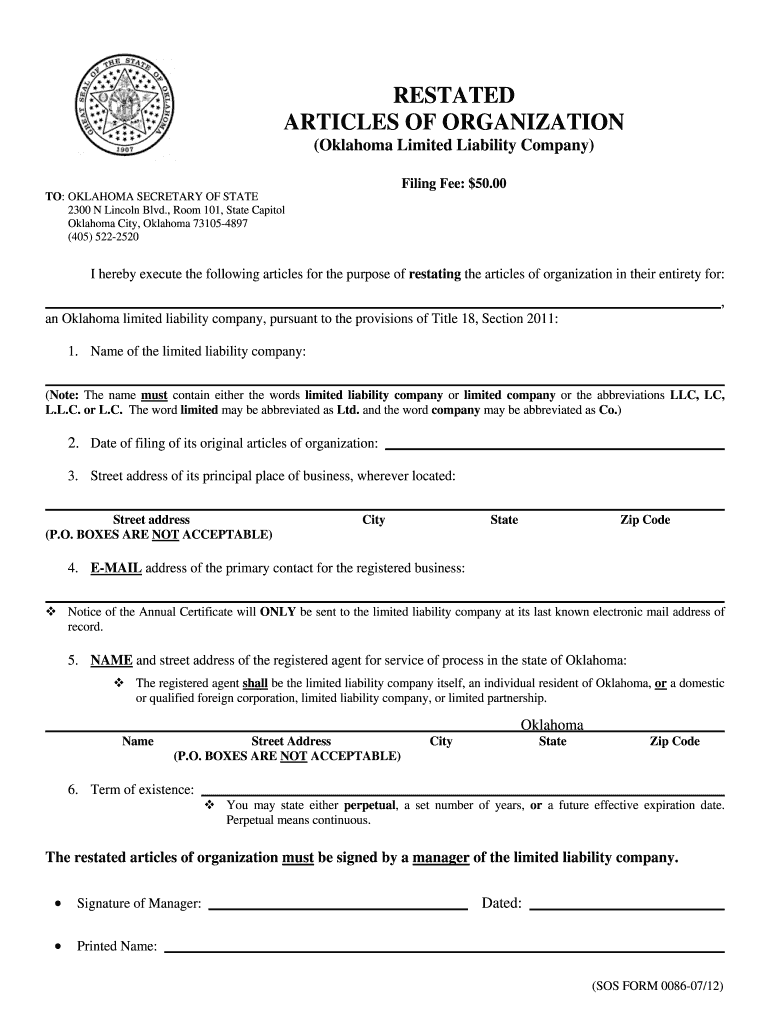

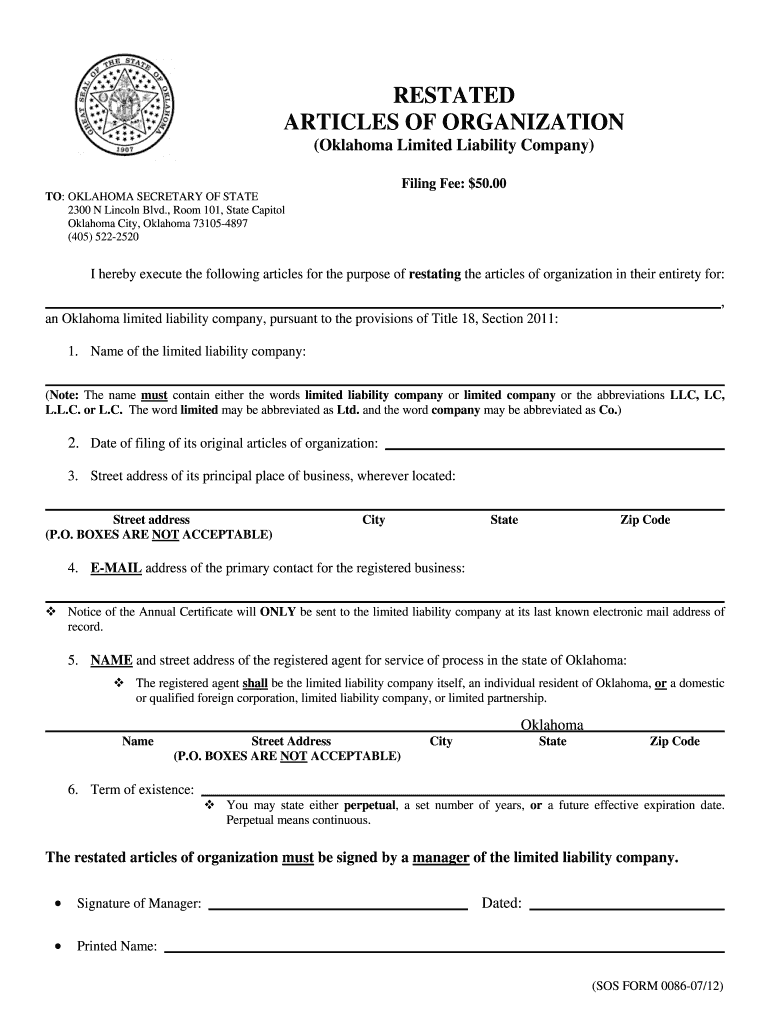

This document is used to restate the articles of organization for an Oklahoma limited liability company. It requires various details such as the name, original filing date, principal place of business,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign limited company form

Edit your oklahoma business forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oklahoma secretary of state llc filing online form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit oklahoma secretary of state articles of organization online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit oklahoma secretary of state llc application form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out limited liability filing form

How to fill out OK SOS Form 0086

01

Obtain the OK SOS Form 0086 from the official website or local office.

02

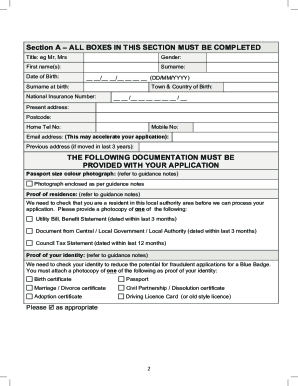

Fill in the required personal information, including name, address, and contact details.

03

Provide any necessary identification numbers, such as Social Security or Tax ID numbers.

04

Complete the specific section related to the purpose of the form as per the instructions.

05

Review all entered information for accuracy and completeness.

06

Sign and date the form at the designated area.

07

Submit the completed form either online or at the appropriate local office.

Who needs OK SOS Form 0086?

01

Individuals applying for certain services or benefits regulated by the Oklahoma Secretary of State.

02

Businesses needing to register or update their information with the state.

03

Anyone requiring official documentation related to state regulations or compliance.

Fill

limited liability

: Try Risk Free

People Also Ask about llc online form

What is a limited company and its characteristics?

Private limited company is held by few individuals privately having a separate legal entity. In this, the shareholders cannot trade publicly shares. It restricts its number of shares to 50. Shareholders cannot sell their shares without the approval of other shareholders.

What type of liability is a Ltd?

In business, limited liability is about reducing your personal exposure to financial risk. If your business fails (or is sued) then the amount of money for which you are liable is limited by the business structure.

What do you mean by a limited liability company?

A limited liability company (LLC) is a business entity that prevents individuals from being liable for the company's financial losses and debt liabilities. In the event of legal action or business failure, liability is assumed by the company rather than its constituent partners or shareholders.

What are 3 advantages of an LLC?

Limited Personal Liability. Less Paperwork. Tax Advantages of an LLC. Ownership Flexibility. Management Flexibility. Flexible Profit Distributions.

What do you mean by limited liability?

limited liability, condition under which the losses that owners (shareholders) of a business firm may incur are limited to the amount of capital invested by them in the business and do not extend to their personal assets.

Who is liable in a limited liability company?

By forming an LLC, only the LLC is liable for the debts and liabilities incurred by the business—not the owners or managers. However, the limited liability provided by an LLC is not perfect and, in some cases, depends on what state your LLC is in.

What is a limited liability company?

A limited liability company (LLC) is a business structure in the U.S. that protects its owners from personal responsibility for its debts or liabilities. Limited liability companies are hybrid entities that combine the characteristics of a corporation with those of a partnership or sole proprietorship.

What are the main characteristics of an LLC?

The main characteristics of an LLC concern formation, maintenance, continuity, ownership, control, personal liability of owners, compensation, and taxation.

What kind companies have limited liability?

An LLC is a corporate structure in the United States whereby the owners are not personally liable for the company's debts or liabilities. Limited liability companies are hybrid entities that combine the characteristics of a corporation with those of a partnership or sole proprietorship.

What is an example of a limited company?

An example of this would be 'Green Construction Ltd'. Any type of business can set up as a private limited company – for example, a plumber, hairdresser, photographer, lawyer, dentist, accountant or driving instructor. The owners of a private limited company are known as shareholders .

What is the liability of a limited liability company?

Limited liability means that the assets and debts of the business remain separate from the personal assets and debts of the company's owners. If a company goes bankrupt, creditors cannot therefore go after the owners' personal assets, just that of the business.

What are 3 characteristics of a limited liability company also known as a LLC )?

Characteristics of limited liability company include separate legal existence, limited liability, flexibility in taxation, and simplicity in operation.

How do you define limited liability company?

A Limited liability company (LLC) is a business structure that offers limited liability protection and pass-through taxation. As with corporations, the LLC legally exists as a separate entity from its owners. Therefore, owners cannot typically be held personally responsible for the business debts and liabilities.

What are 3 characteristics of a limited liability company?

Characteristics of limited liability company include separate legal existence, limited liability, flexibility in taxation, and simplicity in operation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get file llc online oklahoma?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the llc paperwork oklahoma in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit llc forms online in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your articles of incorporation oklahoma, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I edit oklahoma secretary of state trade name on an iOS device?

Create, edit, and share how to form an llc in oklahoma online from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is OK SOS Form 0086?

OK SOS Form 0086 is a form used in Oklahoma for reporting certain business information to the Secretary of State's office.

Who is required to file OK SOS Form 0086?

Entities that are registered to do business in Oklahoma and are subject to specific reporting requirements must file OK SOS Form 0086.

How to fill out OK SOS Form 0086?

To fill out OK SOS Form 0086, you need to provide the required information in the designated sections of the form, including details about the business, its officers, and any required financial information.

What is the purpose of OK SOS Form 0086?

The purpose of OK SOS Form 0086 is to ensure compliance with Oklahoma business regulations and to keep the state informed about active businesses and their financial status.

What information must be reported on OK SOS Form 0086?

Information that must be reported on OK SOS Form 0086 includes the business's legal name, address, type of business, names and addresses of owners or officers, and financial information as required.

Fill out your OK SOS Form 0086 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

This Typically Includes The Name And Address The Form Carefully Ensuring Accuracy And Completeness is not the form you're looking for?Search for another form here.

Keywords relevant to oklahoma secretary of state business registration

Related to oklahoma llc articles of organization form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.